The tax compliance burden is six percent of total federal outlays in 2022 ($6.3 trillion) and amounts to $1,076 per U.S. It is more than Amazon’s sales in North America in 2022. To put this figure into context, if you were to count to $364 billion at a rate of $1 per second, it would take you over 11,500 years.

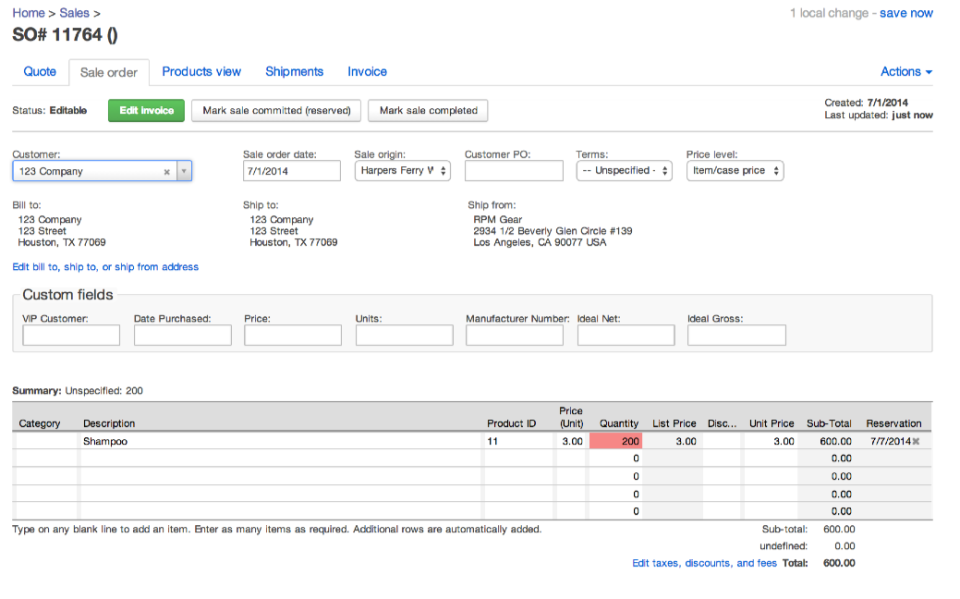

#Finale inventory rename a product code

Add to that the $104 billion in estimated out-of-pocket costs taxpayers spent on software, professional preparation services, or other filing expenses, and the total economic value of the compliance burden imposed by the tax code can be calculated at $364 billion. The opportunity cost of the billions of hours spent on taxes is equivalent to $260 billion in labor – valuable time that could have been devoted to more productive or pleasant pursuits but was instead lost to tax code compliance.

Because of inflationary pressures, the cost of labor was up 5.6 percent from 2021 ($38.07). This includes all wages, salaries and benefits provided. non-federal civilian employers spent an average of $40.23 per hour worked by their employees in December 2022.

According to the Bureau of Labor Statistics (BLS), U.S. We calculate an estimate of the value of this time burden using private sector labor costs. This annual NTUF estimate of tax complexity uses analysis of data and supporting documentation that the Internal Revenue Service (IRS) files with the Office of Information and Regulatory Affairs (OIRA), and finds that complying with the tax code in 2022 consumed 6.55 billion hours for recordkeeping, learning about the law, filling out the required forms and schedules, and submitting information to the IRS. The Tax Code’s Increasing Complexity and Compliance Burden Time and Cost Burdens Increased Again in 2022 This could lead to more compliance costs before and after Tax Day. The $46 billion in new enforcement funding is intended to subject more taxpayers to audits (and more scrutinous and time-consuming audits). The IRS plans to bu rn through that funding in the next few years, before the 10-year spend period for the $80 billion in funding is up. Over the last several months, the IRS has touted how it is using the $80 billion provided to it through the Inflation Reduction Act (IRA) to improve taxpayer services, but just $3 billion of that pot of money is dedicated for that purpose. More headaches are on the way for taxpayers in the coming years. This estimate also does not attempt to put a dollar value on the confusion, headaches, and stress that tax filing burdens impose on millions of people each year. This estimate is likely an understatement because the IRS has not been able to estimate expenses associated with many of its forms even though they are legally required to do so. We can calculate the value of this burden using average private sector labor costs – which rose by 5.6 percent since a year ago – as a $260 billion per year time drain.Īltogether, this year’s tax complexity burden is $364 billion – $25 billion (7.4 percent) more than a year ago.

And with inflation, people’s time has become more valuable. This imposes a huge opportunity cost on individuals, businesses, and the economy because time is money. Taxpayers must gather the necessary receipts, statements, and records, and try to make sense of and fill out the IRS’s tax forms. In addition to monetary expenses, Americans also spend an estimated 6.55 billion hours complying with the tax laws.

#Finale inventory rename a product software

The complexity of the tax laws, a lack of clarity in instructions and regulatory guidance, the inability to get basic questions answered by IRS agents, the worry of missing out on a credit or deduction, and the fear of making an audit-triggering mistake mean that more and more taxpayers turn to software or professional tax preparers every year. But that is just a drop in the bucket compared to other related expenses. Some entail basic costs such as making copies of financial statements, receipts, or forms. This report, NTUF’s annual study of the tax system, finds that compliance burdens are increasing for the second consecutive year.įor starters, taxpayers spend $104 billion a year on out-of-pocket expenses associated with preparing and submitting tax forms. As painful as it can be to have to cut a check to the IRS every April, the process is much more arduous and confusing than it should be. The Internal Revenue Service (IRS) collects almost $5 trillion in individual income, corporate income, and payroll taxes each year, but the burden of our tax system is much more than that.

0 kommentar(er)

0 kommentar(er)